Intraday Trading: Tips, Strategies & Basics

Intraday trading is riskier than investing in the regular stock market. It is important, especially for beginners, to understand the basics of such trading to avoid losses. Individuals are advised to invest only the amount they can afford to lose without facing financial difficulties.

- A few intraday trading tips discussed below should help investors in making the right decision.

Choose Two or Three Liquid Shares

Intraday trading involves squaring open positions before the end of the trading session. This is why it is recommended to choose two or three large-cap shares that are highly liquid. Investing in mid-size or small-caps can result in the investor having to hold these shares because of low trading volumes.

Determine Entry and Target Prices

Before placing the buy order, you must determine your entry level and target price. It is common for a person’s psychology to change after purchasing the shares. As a result, you may sell even if the price sees a nominal increase. Due to this, you may lose the opportunity to take advantage of higher gains because of the price increase.

Utilizing Stop Loss for Lower Impact

Stop loss is a trigger that is used to automatically sell the shares if the price falls below a specified limit. This is beneficial in limiting the potential loss for investors due to the fall in the stock prices. For investors who have used short-selling, stop loss reduces loss in case the price rises beyond their expectations. This strategy ensures emotions are eliminated from your decision.

Book Your Profits when Target is reached

Most day traders suffer from fear or greed. It is important for investors to not only cut their losses, but also to book their profits once the target price is reached. In case the individual thinks the stock has a further possibility of rising in price, the stop loss trigger must be readjusted to match this expectation.

Avoid being an Investor

Intraday trading, as well as investing, requires individuals to purchase shares. However, factors for both these strategies are distinct. One kind adopts fundamentals while the other considers the technical details. It is common for day traders to take delivery of shares in case the target price is not met. He or she then waits for the price to recover to earn back his or her money. This is not recommended because the stock may not be worthy of investing, as it was purchased only for a shorter duration.

Research your Wish list thoroughly

Investors are advised to include eight to 10 shares in their wish lists and research these in depth. Knowing about corporate events, such as mergers, bonus dates, stock splits, dividend payments, etc., along with their technical levels is important. Using the Internet for finding resistance and support levels will also be beneficial.

Don’t Move against the Market

Even experienced professionals with advanced tools are not able to predict market movements. There are times when all technical factors depict a bull market; however, there may still be a decline. These factors are only indicative and do not provide any guarantees. If the market moves against your expectations, it is important to exit your position to avoid huge losses.

Stock returns can be huge; however earning smaller gains by adhering to these intraday trading tips should be satisfactory. Intraday trading provides higher leverage, which effectively provides decent returns in one day. Being content is crucial to succeeding as a day trader.

- Rules for Intraday Trading

Most traders, especially beginners, lose money in intraday trading because of the high volatility of the stock markets. Generally, losses occur due to fear or greed because, while investment is not risky, the lack of knowledge is.

Basic Rules for Intraday Trading

Timing the Market:

Experts often recommend individuals avoid trading during the first hour, once the markets open. Taking positions between noon and 1pm can increase the possibility of earning profits.

Plan Investment Strategy and Stick to it:

Every time users initiate a trade, it is important for them to have a clear plan of how to do intraday trading. Determining the entry and exit prices before initiating the trade is crucial. One of the most important intraday trading tips is to use the stop loss trigger to reduce the potential loss on your position. Moreover, once the stock achieves the target price, users are advised to close their position, and not be greedy and expect higher profits.

Exiting the Position under Unfavourable Conditions:

For trades that provide profits and price-give reversal (price expected to show reverse trends), it is prudent to book the profits and exit open position. In addition, if the conditions are not favourable to the position, it is advisable to immediately exit and not await the stop-loss trigger to be activated. This will help traders reduce their losses.

Invest Small Amounts that Won’t Pinch:

It is not uncommon for beginners to get carried away once they make some profits during day trading. However, markets are volatile and predicting the trends is not easy even for seasoned professionals. In such situations, beginners can easily lose all their investments. This is why an important intraday tip is to invest smaller sums that a user can afford to lose. This will ensure individuals do not face financial difficulties in case the markets do not favour them.

Research and Choose Liquid Stocks:

Before commencing intraday trading, it is recommended to understand the basics of the stock market, and the fundamental and technical analyses. There is plenty of research available on the Internet and taking the time to read it will be advantageous. Moreover, there are hundreds of stocks that are traded on the equity markets and traders must trade only two or three liquid stocks. Liquid stocks are those shares that have high volumes in the intraday market. This allows traders to exit open positions before the end of the trading sessions.

Always Close All Open Positions:

Some traders may get tempted to take delivery of their positions in case their targets are not achieved. This is one of the biggest errors and it is crucial to close all open positions even if traders have to book a loss.

Spend Time:

Day trading is not for professionals who are employed in a full-time job. Traders must be able to monitor the market movements throughout the market session (from opening bell until its closing) to enable them to make the right calls as required.

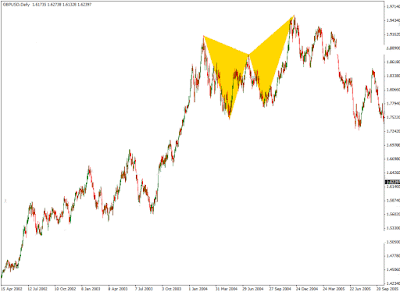

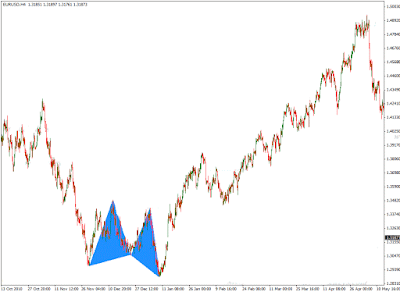

- Intraday Trading indicators

When it comes to booking profits in intraday trading, you will require to do a lot of research. For the same purpose, you need to follow certain indicators. Often intraday tips are believed to be the Holy Grail; this, however, is not entirely accurate. Intraday Trading indicators are beneficial tools when used with a comprehensive strategy to maximize returns.

- How to make profit in intraday trading

Intraday traders always face inherent risks that exist in the stock markets. Price volatility and daily volume are a couple of factors that play an important role in the stocks picked for daily trading. Traders must not risk over two per cent of their total trading capital on a single trade to ensure the right risk management. So here are a few tips shared to make profit in intraday trading.

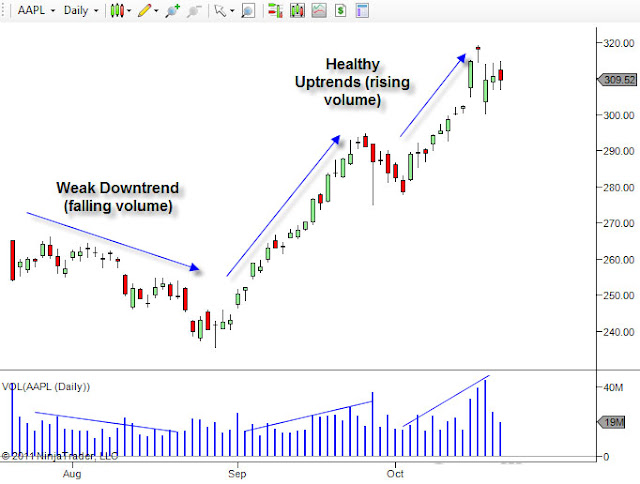

Intraday Time Analysis

When it comes to intraday trading, daily charts are the most commonly used charts that represent the price movements on a one-day interval. These charts are a popular intraday trading technique and help illustrate the movement of the prices between the opening bell and closing of the daily trading session. There are several methods in which intraday charts can be used. Below are some of the most commonly used charts while intraday trading on the Indian stock market. Know more about intraday trading time analysis.

- How to Choose Stocks for Intraday Trading

To succeed as a day trader, it is important to know how to pick stocks for intraday trading. Often people are unable to make profits because they fail to select appropriate stocks to trade

Day trading, if not managed properly, can have drastic results on the financial well-being of users. The temptation of earning huge profits in a short period of time can entice traders. However, with incomplete understanding and knowledge, intraday trading can be harmful.