By looking at the balance sheet of the company one can understand how the company has build wealth for itself and its owners over the past years.

Balance sheet of a company makes one

thing clear about the business, it talks about from where the company is

generating funds to run its business, and where the company is using those

funds.

Any company generate funds in three

possible ways. It can borrow money from stock market. This is called share

capital in balance sheet.

The company can also retain its net

profits to run the business. This is called reserves and surplus in the

balance sheet.

Company can also borrow funds from

Bank etc. This is recorded as long term borrowing and short term borrowing in

balance sheet.

Hence, the total funds available

with a company to run its business can be summed up like this:

Total Funds = Share Capital +

Reserves + Debt.

{Note: Share Capital + Reserves =

Book Value.}

This (total funds) is also called

the total liability of the company.

How the company uses their generated

funds is also indicated in the balance sheet.

Company use its generated funds to

build assets. These assets intern generate income for the company.

Let’s see the important constituents

of a balance sheet in more detail.

Balance sheet basically defines this

equation:

If one read a balance sheet statement

of a company, it will show how much accumulated wealth the company has amassed

till that day.

Shareholders

fund (Book Value / Net Worth)

Why it is called as shareholders

fund?

Shareholders fund is that money that

companies owe to their shareholders.

Shareholders have a legal claim on

the company’s net profits. Hence any funds that is retained by the company

(Reserves) goes into the account of shareholders funds.

Company consider these funds as that

money which they need to pay-back to the shareholders one day.

Book Value = Share Capital +

Reserves

Share capital: is that money that the company has generated from its IPO.

Share capital is actually the

borrowed money that the company has taken from the shareholders.

It is also treated as companies

liability.

Reserves :are also referred as retained net profits of the company.

Why companies retain their profits?

This is done to strengthen their balance sheet (financial position).

Companies used a reserves to buy new

fixed assets. This day 2 by means of capital expenditure plans (CAPEX).

Companies also use their reserves to

reduce there debt burden.

A portion of reserves is also used

to pay dividends to its existing shareholders.

General there are two types of

reserves. First, revenue reserve and second, is called capital Reserves.

Revenue reserves is again

categorized into two types, first he is general reserves and second is specific

reserves.

As the name suggests, general

reserves is not apportioned for any specific purpose. They are just kept in

the balance sheet to strengthen the financial position of the company.

Specific reserves are those portion of money which is kept for specific

purpose. The the funds kept in the specific reserve shall be used only for the

designated purpose.

How the reserves in the balance

sheet is funded every year?

The annual profits of the company

that is shown as net profit, in profit and loss account, is transferred to the

company’s balance sheet as retained earnings.

This retained earning in turn is

used as the reserves of the company.

If the company has made a loss in a

particular financial year, no transaction is recorded in the reserves column of

the balance sheet.

Sometimes, in case of loss, the

company may even debit there reserves account in balance sheet to meet their

requirements.

In such case one will find a dip in

the reserves and surplus account as compared to the previous year.

One of the most important financial

indicator detailed in the Balance Sheet is shareholders equity. In doing a

balance sheet analysis it plays an important role.

Net worth of a company is equal to

total capital generated by the company by issuing stocks and accumulated

retained earnings.

A continuously improving net worth

is what investors likes to see in companies balance sheet.

Investors must compare last five

years net worth of the company, and must also check growth rate.

It is important to check how the net

worth of company has grown.

If increase in net worth is

attributable only to the issuance of more stocks to public, then it is not

good.

Ideally, the companies net worth

must increase due to growth in retained earnings.

Liability

Non current liabilities

Non current liabilities are those

liabilities of a company which is settled only after 12 months from the date of

reporting.

These are such liabilities that

company need not settle immediately.

If you will see in moneycontrol.com,

you will find that non current liabilities are mainly recorded in two three

some heads. First he’s long term borrowing. Second, is deferred tax liability

and third is long term provisions.

Companies which show the line item

has long term borrowing, means that the company has taken that from the market

(mainly banks).

It is very important for the

shareholders to keep a note of how high is the long term borrowings of the

company as compared to its equity.

Deferred tax liability is a

provisional fund maintained by the company using which they will pay the

forthcoming additional tax dues.

Has a part of non current liability

the company also hello kids some funds in the name of long term provisions.

Here the company keeps some cash reserves for paying their employees. These

payments can be like gratuity, provident funds, leave encashment. The

provisions can also be made for income tax payment, payment of dividend to

shareholders, dividend distribution tax etc.

Current liabilities

Current liabilities are those

obligation of the company that they must meet before 12 months.

If you will look into balance sheet

of any company in moneycontrol.com you will find four line items under the

heading current liabilities. They are, short term borrowing, trade payables,

other current liability and short term provisions.

Short term borrowing is essentially

that loan that company has taken from Bank CTC to fund there day-to-day cash

flow requirement. In financial term this is also called as working capital of

the company.

Trade payable is that money that a

company must pay to its suppliers within next 12 months.

Short term provisions are again

similar to long term provisions. The only difference here he is, this

provisions me get used within next 12 months.

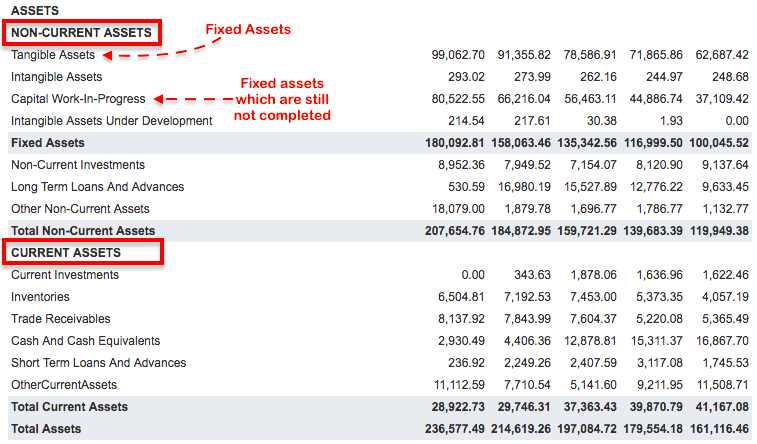

Assets

Generally in the balance sheet,

assets are categorised into two main types: non-current assets and current

assets.

Non-current assets are basically

property, plant, and equipment’s of the company. Normal terms we call it as

fixed assets of the company (Tangible assets).

Fixed Assets (Tangible Assets)

Fixed assets adults assets of the

company which they use directly for the production of goods and services for

their customers.

Common examples of fixed assets are

land, factory buildings, machines, furniture’s, Motor vehicles etc.

Fixed assets are those assets of the

company which company gathers to hold them for long-term.

Contrast to the fixed assets, an

inventory is also an asset of the company. But company maintains the inventory

with the objective of selling them in near future.

Intangible assets

Assets of the company do not have a

physical substance. You cannot physically see it and touch it. Example off in

tangible assets can be like copyrights, trademarks, patents etc gathered

by the company over a period of time.

Capital work in progress

These are those assets which were

not ready at the time of preparation of the balance sheet. These are those

assets which are still not ready to produce goods and services for the company.

Hence, call costs that has gone into

the preparation of that as it is shown as capital work in progress off the

companies balance sheet.

Just to understand, let’s take a

small example. Pause cement manufacturing plant is putting up a new facility to

manufacture a new brand of cement. Average it may take 3 years for the company

to start production from this new facility. But the company will start spending

money on this asset from the first months itself. So, the cost that was into

the preparation of the new cement plant will be booked as capital work in

progress for the next three years.

As soon as the new plant will begin

production, all capital work in progress associated with this new plant will be

transferred as tangible asset.

Non-current investments

Current investments are those

investments made by the company which day would like to hold for more then next

12 months. Example of such an investment can be stockholding of another

company.

Generally current investments are

reported in the balance sheet equivalent to the market valuation of the

investment.

Current assets

Current assets are those assets of

the company which is expected to be converted into cash within next one year.

It is the current assets of the

company that helps them to maintain enough liquidity.

Current assets of the company helps

in management of the current liabilities.

One of the most reliable firms of

current assets cash and cash equivalent, inventory, it’s investments, account

receivables from its customers, and loans and advances given to associates/

suppliers. Advances are also referred to as pre-paid expenses in some balance

sheets.

To

Conclude

You can see the above snapshot of a

typical balance sheet of a company and understand what is actually balanced in

a balance sheet.

Total asset of a business is always

equal to the sum of its total liability and shareholders funds.

How

balance sheet is related with its profit and loss accounts?

Reserves & Surplus in balance sheet gets updates every time the company makes

net profit (PAT). Net profit appears in companies profit and loss

accounts.

Debt (long term and short term borrowings) in balance sheet

increases the companies Finance cost which appears in companies profit

and loss accounts.

Trade payables of the balance sheet is a portion of expense to be

incurred by the company in the next financial year (FY). Companies often buy goods

and services from the suppliers on credit. All expenses which are booked by the

company appears in the profit and loss accounts.

Tangible assets valuation appearing

in balance sheet are recorded as net of accumulated depreciation (over last

several years of operation). Depreciation applicable only for a particular FY,

appears in the companies profit and loss accounts.

Non-current and current investments made by the company is recorded in companies balance sheet.

The income generated by these investments are recorded as other income

in profit and loss accounts.

Trade receivables appearing in

balance sheet of the company is the out of sales revenue. Companies often sell

their products and services to their customers on credit. This credit payment

due, to be paid by next months are recorded as trade receivable.

So now you can understand well, how

balance sheet and profit and loss accounts communicate with each other.

Disclaimer: All blog posts of https://nse-bse-mcx-technicalanalysis.blogspot.com/ are for

information only. No blog posts should be considered as an investment

advice or as a recommendation. The user must self-analyze all securities

before investing in one.