Market conditions

Before reading this lesson, you should have previously read through:

It is useful to be able to identify the different types of market conditions, as this can help you make trading decisions, such as in which you should trade or which particular to use.

There are two types of market conditions: trending and ranging.

Trending market

A trending market is when the price is clearly moving in one particular direction. If the price is moving up, then it is said to be in an ; if the price is moving down, then it is said to be in a .

A trending market is when the price is clearly moving in either an uptrend or a downtrend.

Many trade in the direction of the trend because there is a higher probability of the trade being profitable. There is a distinct advantage for traders who identify a trend early on — entering the market when a trend is beginning to develop means it is more likely to return a profitable result.

Uptrend

The below demonstrates an uptrend. You can clearly see the price is moving up and that the uptrend is made from a series of peaks and troughs — the price does not move straight up, it moves up in waves. The peaks make the and the troughs make the .

number_1 Higher lows

number_2 Higher highs

number_2 Higher highs

In an uptrend, the market direction can be identified by a series of higher highs and higher lows.

Downtrend

In a downtrend, the price behaves in the same way, moving down in waves, with a series of peaks and troughs that make the highs and lows respectively. A downtrend can be identified by a series of lower lows and lower highs.

number_1 Lower lows

number_2 Lower highs

number_2 Lower highs

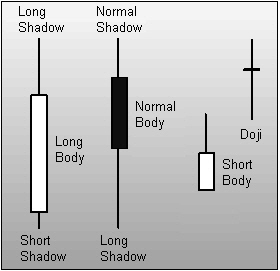

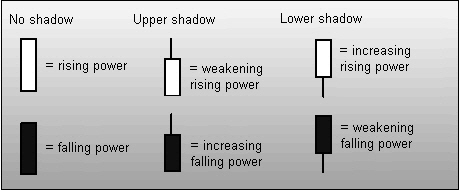

It is important to note that in an uptrend, not every candle is and in a downtrend, not every candle is ; in a trending market the price is moving in an overall direction.

You can practice determining the trend direction in the following exercises:

Can you determine the market direction on the following chart?

number_3

Solution

Ranging market

The other type of market condition is a ranging market, sometimes referred to as a sideways market. You can see from the chart below that the price is moving within a range; there is no clear sustained uptrend or downtrend.

In a ranging market, the price moves within an upper boundary or , and a lower boundary or . The upper and lower levels may not always be exact or clear to observe, however what you will see is the price rising and falling within a maximum and minimum price zone.

Determining a correction from a reversal

There is a distinct difference between a correction and a and it is important to differentiate between the two.

A correction is when the market pulls back, but continues on in the trend direction. A reversal is when price completely reverses in the opposite direction of the trend.

Corrections

A correction — sometimes referred to as a retracement — is when the market moves in the direction of the trend, pulls back for a short time and then continues on in the original trend direction.

The charts below show a correction in an uptrend and in a downtrend, respectively.

number_1 Confirmed uptrend

number_2 Correction to the downside

number_2 Correction to the downside

number_1 Confirmed downtrend

number_2 Correction to the upside

number_2 Correction to the upside

You can practice finding price corrections in the following exercises:

Reversals

A reversal is when the market direction changes completely and reverses the other way. The charts below illustrate a reversal to the downside and a reversal to the upside.

number_1 Confirmed uptrend

number_2 Reversal to the downside

number_2 Reversal to the downside

number_1 Confirmed downtrend

number_2 Reversal to the upside

number_2 Reversal to the upside

You can practice finding reversals in the following exercises:

Summary

So far you have learned ...

- ... there are two types of market conditions: trending and ranging.

- ... an uptrend can be identified as a series of higher highs and higher lows.

- ... a downtrend can be identified as a series of lower highs and lower lows.

- ... ranging is when the price is trading between an upper and lower boundary.

- ... a correction – or retracement – is a temporary pull back when the price is trending.

- ... a reversal is where the price direction changes completely and reverses in the opposite direction.