Volume Analysis Patterns

Volume is one of the tools professional traders use to find clues about possible market movement as well as confirmations to trends.Volume data is most accurate in stock, future, and commodity exchanges. This is due to the fact that all of these are regulated exchanges. While most of the trading that happens on these exchanges is electronic nowadays, every order still has to be cleared with the exchange in the end, so no matter how large or small the quantity traded is, it is registered in the database.

In Forex trading things are different. Volume data is measured by how

many ticks are registered in time frame chosen in the chart. For those

who don’t know what a tick is, it is a transaction (filled order) made

in the underlying instrument regardless of the quantity traded. A

tick charts draws bars based on the predefined number of trades

conducted (if you have a 50-tick chart then each bar is closed at the

end of the 50th trade, regardless of how much time it takes to conduct

these trades. This means a transaction of 1 mini lot is a tick and a transaction of 10 standard lots (buying or selling 10 lots together as 1 single order) is also a tick.

With the absence of a single exchange that processes all orders in

Forex, each broker calculates volume based on their own ticks taken from

there trades database.

The bottom line is, the following patterns are best applied to stock

and future contracts and not of much value in the Foreign Exchange

trading.

To produce meaningful signals, volume is coupled with price data in these patterns.

Accumulation

Accumulation, which indicates that buyers are loading up on a certain

stock or a futures contract, is signaled by a slowing in the downtrend

(or price going nowhere) while the volume stays high.

Distribution

The opposite of accumulation is indicated by a slowing in the uptrend

(or price going nowhere), while volume stays high. Which means that

sellers are starting to takeover in the underlying market.

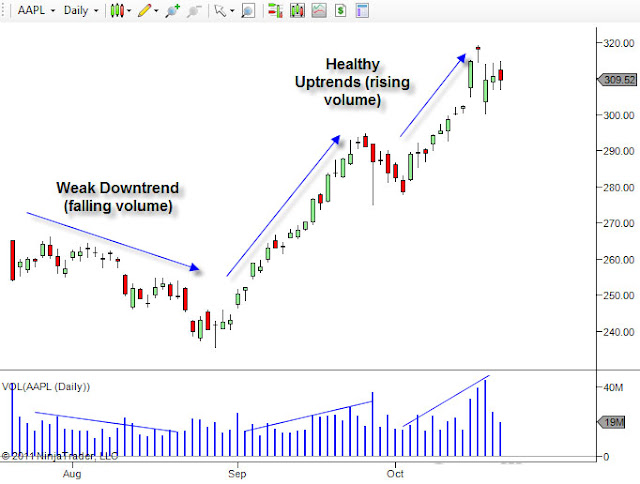

Confirmation of Trend

For a trend to be healthy whether it is an uptrend or a downtrend,

volume has to be increasing in each up or down swing. The volume data

acts as a confirmation of the trend in this case. A decreasing volume

means that the trend is nearing its end or at least about to stall.

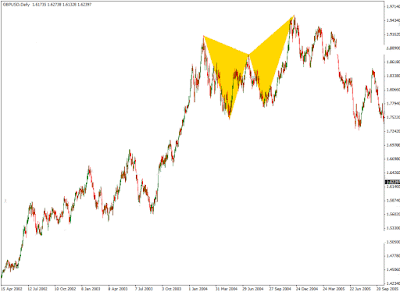

Volume Spikes

Sometimes volume spikes, accompanied with other reversal signals with

gaps or candlestick patterns, signal the end of a decent run in price.

This can be very aggressive and needs extra precaution.

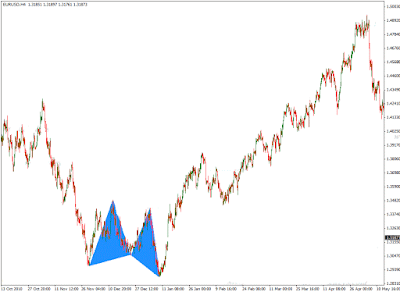

Breakout Signals

To gauge the interest and therefore determine the probable direction

of the breakout of a trading range, determine the trading range that you

want to monitor, then watch the overall volume in the duration of the

trading range.

Generally speaking, higher volume leading to the breakout (whether up or

down), gives more value to the breakout. There is also the

follow-through volume, which is high volume after the breakout has

occurred. This also adds to the strength of the breakout.

Notes of Precaution

- Volume is relative so when dealing with volume bars I found the best way to put things in context is drawing trend lines across volume bars. This helps understanding the story that volume tells.

- Volume signals aren’t enough by themselves, instead they act to confirm your other signals or refute them. Don’t rely on volume alone to produce signals.