Fibonacci Who?

We will be using Fibonacci ratios a lot in our trading so you better learn it and love it like your mother's home cooking. Fibonacci is a huge subject and there are many different Fibonacci studies with weird-sounding names but we're going to stick to two: retracement and extension. Let us first start by introducing you to the Fib man himself...Leonardo Fibonacci.

He had an "Aha!" moment when he discovered a simple series of numbers that created ratios describing the natural proportions of things in the universe.

The ratios arise from the following number series: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144...

This series of numbers is derived by starting with 1 followed by 2 and then adding 1 + 2 to get 3, the third number. Then, adding 2 + 3 to get 5, the fourth number, and so on.

After the first few numbers in the sequence, if you measure the ratio of any number to the succeeding higher number, you get .618. For example, 34 divided by 55 equals .618.

If you measure the ratio between alternate numbers you get .382. For example, 34 divided by 89 = 0.382 and that's as far as into the explanation as we'll go.

These ratios are called the "golden mean". Okay that's enough mumbo jumbo. With all those numbers, you could put an elephant to sleep. We'll just cut to the chase; these are the ratios you HAVE to know:

Fibonacci Retracement Levels

0.236, 0.382, 0.500, 0.618, 0.764

0.236, 0.382, 0.500, 0.618, 0.764

Fibonacci Extension Levels

0, 0.382, 0.618, 1.000, 1.382, 1.618

0, 0.382, 0.618, 1.000, 1.382, 1.618

You won't really need to know how to calculate all of this. Your charting software will do all the work for you. Besides, we've got a nice Fibonacci calculator that can magically calculate those levels for you. However, it's always good to be familiar with the basic theory behind the indicator so you'll have the knowledge to impress your date. Traders use the Fibonacci retracement levels as potential support and resistance areas. Since so many traders watch these same levels and place buy and sell orders on them to enter trades or place stops, the support and resistance levels tend to become a self-fulfilling prophecy. Traders use the Fibonacci extension levels as profit taking levels. Again, since so many traders are watching these levels to place buy and sell orders to take profits, this tool tends to work more often than not due to self-fulfilling expectations. Most charting software includes both Fibonacci retracement levels and extension level tools. In order to apply Fibonacci levels to your charts, you'll need to identify Swing High and Swing Low points. A Swing High is a candlestick with at least two lower highs on both the left and right of itself. A Swing Low is a candlestick with at least two higher lows on both the left and right of itself. You got all that? Don't worry, we'll explain retracements, extensions, and most importantly, how to grab some pips using the Fib tool in the following sections.

Fibonacci Retracement

The first thing you should know about the Fibonacci tool is that it works best when the market is trending.

The idea is to go long (or buy) on a retracement at a Fibonacci support level when the market is trending up, and to go short (or sell) on a retracement at a Fibonacci resistance level when the market is trending down.

In order to find these retracement levels, you have to find the recent significant Swing Highs and Swings Lows. Then, for downtrends, click on the Swing High and drag the cursor to the most recent Swing Low.

For uptrends, do the opposite. Click on the Swing Low and drag the cursor to the most recent Swing High.

For uptrends, do the opposite. Click on the Swing Low and drag the cursor to the most recent Swing High.

Got that? Now, let's take a look at some examples on how to apply Fibonacci retracements levels in the markets.

Uptrend

This is a daily chart of AUD/USD.Here we plotted the Fibonacci retracement Levels by clicking on the Swing Low at .6955 on April 20 and dragging the cursor to the Swing High at .8264 on June 3. Tada! The software magically shows you the retracement levels.

As you can see from the chart, the retracement levels were .7955 (23.6%), .7764 (38.2%), .7609 (50.0%), .7454 (61.8%), and .7263 (76.4%).

Now, the expectation is that if AUD/USD retraces from the recent high, it will find support at one of those Fibonacci levels because traders will be placing buy orders at these levels as price pulls back.

Now, let's look at what happened after the Swing High occurred.

Price pulled back right through the 23.6% level and continued to shoot down over the next couple of weeks. It even tested the 38.2% level but was unable to close below it.

Later on, around July 14, the market resumed its upward move and eventually broke through the swing high. Clearly, buying at the 38.2% Fibonacci level would have been a profitable long term trade!

Downtrend

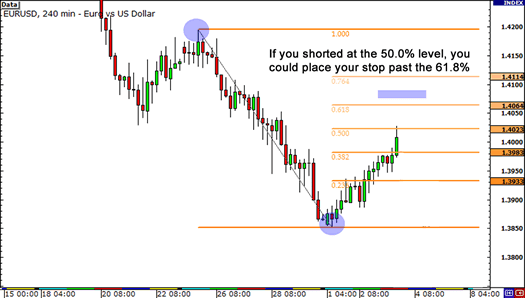

Now, let's see how we would use the Fibonacci retracement tool during a downtrend. Below is a 4-hour chart of EUR/USD.As you can see, we found our Swing High at 1.4195 on January 26 and our Swing Low at 1.3854 a few days later on February 2. The retracement levels are 1.3933 (23.6%), 1.3983 (38.2%), 1.4023 (50.0%), 1.4064 (61.8%) and 1.4114 (76.4%).

The expectation for a downtrend is that if price retraces from this low, it will encounter resistance at one of the Fibonacci levels because traders will be ready with sell orders there.

Let's take a look at what happened next.

Yowza, isn't that a thing of beauty?!

The market did try to rally, stalled below the 38.2% level for a bit before testing the 50.0% level. If you had some orders either at the 38.2% or 50.0% levels, you would've made some mad pips on that trade.

In these two examples, we see that price found some temporary support or resistance at Fibonacci retracement levels. Because of all the people who use the Fibonacci tool, those levels become self-fulfilling support and resistance levels.

One thing you should take note of is that price won't always bounce from these levels. They should be looked at as areas of interest, or as Cyclopip likes to call them, "KILL ZONES!" We'll teach you more about that later on.

For now, there's something you should always remember about using the Fibonacci tool and it's that they are not always simple to use! If they were that simple, traders would always place their orders at Fib levels and the markets would trend forever.

In the next lesson, we'll show you what can happen when Fibonacci levels fail.

When Fibonacci Fails

Back in previous lesson , we said that support and resistance levels eventually break. Well, seeing as how Fibonacci levels are used to find support and resistance levels, this also applies to Fibonacci! Now, let's go through an example when the Fibonacci retracement tool fails. Below is a 4-hour chart of GBP/USD. Here, you see that the pair has been in downtrend, so you decided to take out your Fibonacci tool to help you spot a good entry point. You use the Swing High at 1.5383, with a swing low at 1.4799. You see that the pair has been stalling at the 50.0% level for the past couple of candles. You say to yourself, "Oh man, that 50.0% Fib level! It's holding baby! Time to short this sucka!" You short at market and start day dreaming that you'll be driving down Rodeo Drive in your new Maserati with Scarlett Johansson (or if you're a lady trader, Robert Pattinson) in the passenger seat...

Now, if you really did put an order at that level, not only would your dreams go up in smoke, but your account would take a serious hit if you didn't manage your risk properly!

Take a look at what happened.

It turns out that that Swing Low was the bottom of the downtrend and market began to rally above the Swing High point.

What's the lesson here?

While Fibonacci levels give you a higher probability of success, like other technical tools, they don't always work. You don't know if price will reverse to the 38.2% level before resuming the trend. Sometimes it may hit 50.0% or the 61.8% levels before turning around. Heck, sometimes price will just ignore Mr. Fibonacci and blow past all the levels just like how Lebron James bullies his way through the lane with sheer force.

Remember, the market will not always resume its uptrend after finding temporary support or resistance, but instead continue to go past the recent Swing High or Low.

Another common problem in using the Fibonacci tool is determining which Swing Low and Swing High to use. People look at charts differently, look at different time frames, and have their own fundamental biases. It is likely that Stephen from Pipbuktu and the girl from Pipanema have different ideas of where the Swing High and Swing Low points should be. The bottom line is that there is no absolute right way to do it, especially when the trend on the chart isn't so clear. Sometimes it becomes a guessing game. That's why you need to hone your skills and combine the Fibonacci tool with other tools in your trading toolbox to help give you a higher probability of success. In the next lesson, we'll show you how to use the Fibonacci tool in combination with other forms of support and resistance levels and candlesticks.

Combining Fibs with Support and Resistance

Like we said in the previous section, using Fibonacci levels can be very subjective. However, there are ways that you can help tilt the odds in your favor. While the Fibonacci tool is extremely useful, it shouldn't be used all by its lonesome self. It's kinda like comparing it to NBA superstar Kobe Bryant. Kobe is one of the greatest basketball players of all time, but even he couldn't win those titles by himself. He needs some backup. Similarly, the Fibonacci tool should be used in combination with other tools. In this section, let's take what you've learned so far and try to combine them to help us spot some sweet trade setups. Are y'all ready? Let's get this pip show on the road! One of the best ways to use the Fibonacci tool is to spot potential support and resistance levels and see if they line up with Fibonacci retracement levels. If Fib levels are already support and resistance levels, and you combine them with other price areas that a lot of other traders are watching, then the chances of price bouncing from those areas are much higher. Let's look at an example of how you can combine support and resistance levels with Fib levels. Below is a daily chart of USD/CHF.

As you can see, it's been on an uptrend recently. Look at all those green candles! You decide that you want to get in on this long USD/CHF bandwagon. But the question is, "When do you enter?" You bust out the Fibonacci tool, using the low at 1.0132 on January 11 for the Swing Low and the high at 1.0899 on February 19 for the Swing High. Now your chart looks pretty sweet with all those Fib levels.

Now that we have a framework to increase our probability of finding solid entry, we can answer the question "Where should you enter?" You look back a little bit and you see that the 1.0510 price was good resistance level in the past and it just happens to line up with the 50.0% Fib retracement level. Now that it's broken, it could turn into support and be a good place to buy.

If you did set an order somewhere around the 50.0% Fib level, you'd be a pretty happy camper! There would have been some pretty tense moments, especially on the second test of the support level on April 1. Price tried to pierce through the support level, but failed to close below it. Eventually, the pair broke past the Swing High and resumed its uptrend. You can do the same setup on a downtrend as well. The point is you should look for price levels that seem to have been areas of interest in the past. If you think about it, there's a higher chance that price will bounce from these levels. Why? First, as we discussed in Grade 1, previous support or resistance levels would be good areas to buy or sell because other traders will also be eyeing these levels like a hawk. Second, since we know that a lot of traders also use the Fibonacci tool, they may be looking to jump in on these Fib levels themselves. With traders looking at the same support and resistance levels, there's a good chance that there are a ton of orders at those price levels. While there's no guarantee that price will bounce from those levels, at least you can be more confident about your trade. After all, there is strength in numbers! Remember that trading is all about probabilities. If you stick to those higher probability trades, then there's a better chance of coming out ahead in the long run.

Combining Fibs with Trend Lines

Another good tool to combine with the Fibonacci tool is trend line analysis. After all, Fibonacci levels work best when the market is trending, so this makes a lot of sense! Remember that whenever a pair is in a downtrend or uptrend, traders use Fibonacci retracement levels as a way to get in on the trend. So why not look for levels where Fib levels line up right smack with the trend? Here's a 1-hour chart of AUD/JPY. As you can see, price has been respecting a short term rising trend line over the past couple of days.

You think to yourself, "Hmm, that's a sweet uptrend right there. I wanna buy AUD/JPY, even if it's just for a short term trade. I think I'll buy once the pair hits the trend line again." Before you do that though, why don't you reach for your trading tool box and get that Fibonacci tool out? Let's see if we can get a more exact entry price.

Here we plotted the Fibonacci retracement levels by using the Swing low at 82.61 and the Swing High at 83.84. Notice how the 50.0% and 61.8% Fib levels are intersected by the rising trend line. Could these levels serve as potential support levels? There's only one way to find out!

Guess what? The 61.8% Fib level held, as price bounced there before heading back up. If you had set some orders at that level, you would have had a perfect entry! A couple of hours after touching the trend line, price zoomed up like Astroboy on Red Bull, bursting through the Swing High. Aren't you glad you've got this in your trading toolbox now?

As you can see, it does pay to make use of the Fibonacci tool, even if you're planning to enter on a retest of the trend line. The combination of both a diagonal and a horizontal support or resistance level could mean that other traders are eying those levels as well. Take note though, as with other drawing tools, drawing trend lines can also get pretty subjective. You don't know exactly how other traders are drawing them, but you can count on one thing - that there's a trend! If you see that a trend is developing, you should be looking for ways to go long to give you a better chance of a profitable trade. You can use the Fibonacci tool to help you find potential entry points

Combining Fibs with Candlesticks

If you've been paying attention in class, you'd know by now that you can combine the Fibonacci tool with support and resistance levels and trend lines to create a simple but super awesome trading strategy. But we ain't done yet! In this lesson, we're going to teach you how to combine the Fibonacci tool with your knowledge of Japanese candlestick patterns that you learned in previous lesson. In combining the Fibonacci tool with candlestick patterns, we are actually looking for exhaustive candlesticks. If you can tell when buying or selling pressure is exhausted, it can give you a clue of when price may continue trending. We here like to call them "Fibonacci Candlesticks," or "Fib Sticks" for short. Pretty catchy, eh? Let's take a look at an example to make this clearer. Below is a 1-hour chart of EUR/USD.

The pair seems to have been in a downtrend the past week, but the move seems to have paused for a bit. Will there be a chance to get in on this downtrend? You know what this means. It's time to take the Fibonacci tool and get to work! As you can see from the chart, we've set our Swing High at 1.3364 on March 3, with the Swing Low at 1.2523 on March 6. Since it's a Friday, you decided to just chill out, take an early day off, and decide when you wanna enter once you see the charts after the weekend.

Whoa! By the time you popped open your charts, you see that EUR/USD has shot up quite a bit from its Friday closing price. While the 50.0% Fib level held for a bit, buyers eventually took the pair higher. You decide to wait and see whether the 61.8% Fib level holds. After all, the last candle was pretty bullish! Who knows, price just might keep shooting up!

Well, will you look at that? A long legged doji has formed right smack on the 61.8% Fib level. If you paid attention in Grade 2, you'd know that this is an "exhaustive candle." Has buying pressure died down? Is resistance at the Fib level holding? It's possible. Other traders were probably eyeing that Fib level as well.

Is it time to short? You can never know for sure (which is why risk management is so important), but the probability of a reversal looks pretty darn good!

If you had shorted right after that doji had formed, you could have made some serious profits. Right after the doji, price stalled for a bit before heading straight down. Take a look at all those red candles! It seems that buyers were indeed pretty tired, which allowed sellers to jump back in and take control. Eventually, price went all the way back down to the Swing Low. That was a move of about higher level ! That could've been your trade of the year! Looking for "Fib Sticks" can be really useful, as they can signal whether a Fib level will hold. If it seems that price is stalling on a Fib level, chances are that other traders may have put some orders at those levels. This would act as more confirmation that there is indeed some resistance or support at that price. Another nice thing about Fib Sticks is that you don't need to place limit orders at the Fib levels. You may have some concerns whether the support or resistance will hold since we are looking at a "zone" and not necessarily specific levels. This is where you can use your knowledge of candlestick formations. You could wait for a Fib Stick to form right below or above a Fib level to give you more confirmation on whether you should put in an order. If a Fib stick does form, you can just enter a trade at market price since you now have more confirmation that level could be holding